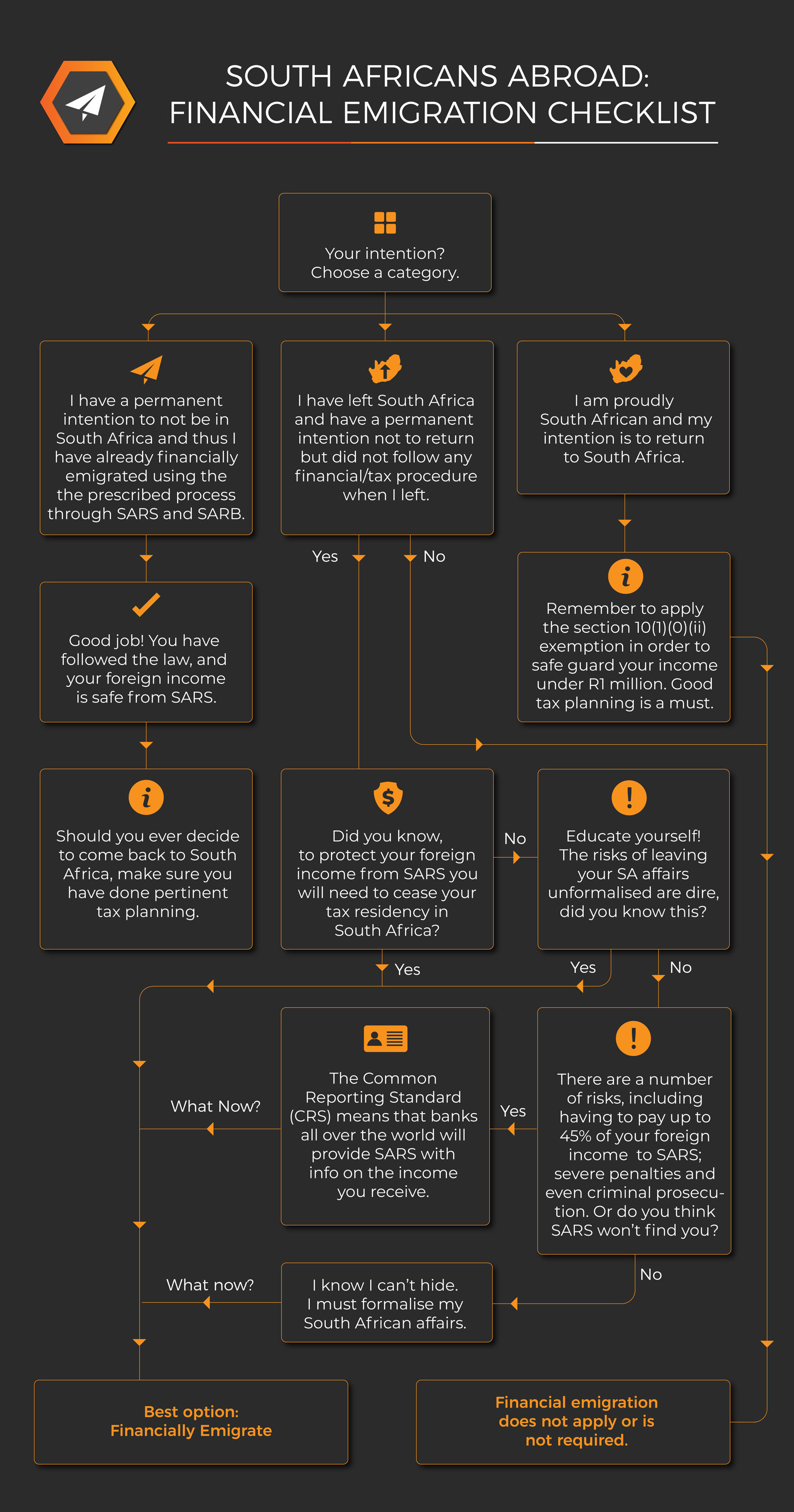

The new expatriate tax law comes into effect 1 March 2020. However, many South Africans abroad believe that the law has not been legally amended and will thus not affect them. This belief is unfortunately incorrect, as the law change has been fully enacted. We have provided a concise breakdown of the tax law above to help you better understand the requirements thereof, and whether or not it is prudent to formalise one’s emigration through SARS and the South African Reserve Bank to protect foreign income earned from South African tax.

Find Us

Johannesburg

17 Eaton Avenue

Bryanston

Gauteng, 2191

South Africa

George

55 York Street

Dormehls Drift

George, 6529

South Africa

Contact Details

Telephone:

South Africa: 011 467 0810

International: +27 11 782 5289

Email:

contact@financialemigration.co.za

In the News

SARS Sharpens Scrutiny of Expatriate SA Tax Residents02/07/2025 - 18:48

SARS Sharpens Scrutiny of Expatriate SA Tax Residents02/07/2025 - 18:48 Coming Home? SARS Tightens Record-Keeping for Returning Expats01/07/2025 - 09:13

Coming Home? SARS Tightens Record-Keeping for Returning Expats01/07/2025 - 09:13 Leaving SA Does Not Abruptly End All One’s Dealings Here, But The Devil Is In The Detail19/06/2025 - 09:15

Leaving SA Does Not Abruptly End All One’s Dealings Here, But The Devil Is In The Detail19/06/2025 - 09:15 Do South African Expats Return Home for the Braais?29/05/2025 - 11:57

Do South African Expats Return Home for the Braais?29/05/2025 - 11:57 Project AmaBillions | Being abroad won’t save you from SARS’ collection efforts21/05/2025 - 15:49

Project AmaBillions | Being abroad won’t save you from SARS’ collection efforts21/05/2025 - 15:49