BACKGROUND

In October 2020 in Parliament, National Treasury and SARS laid down the new Financial Emigration law and made it clear that post 1 March 2021, your retirement money will be locked in for three years, meaning you are not allowed to touch it or best apply it to your personal circumstances.

This is in line with the February 2020 Budget Speech announcement to phase out the SARB portion of Financial Emigration and replace it with a stringent verification test – effectively making it extremely difficult to move money outside of SA when emigrating.

HOW SOUTH AFRICANS ABROAD ARE AFFECTED

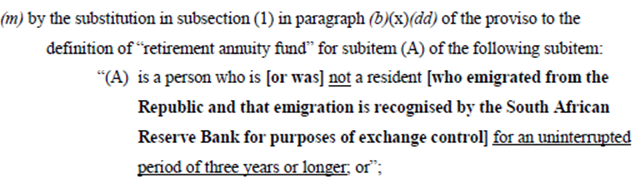

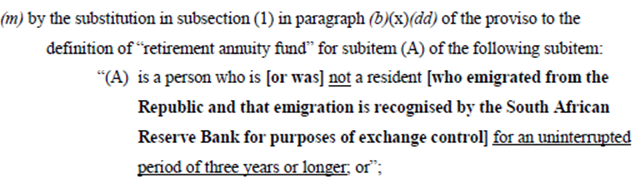

The payment of lump sum benefits upon emigration is to be removed and a new test be introduced where payment is only allowed where a person has remained non-tax resident for a period of at least three consecutive years or longer. This is a double whammy on the back of the “Expat Tax” amendment which took effect from 1 March 2020.

SARB Amendment for “retirement annuity fund”

NEXT STEPS FOR EXPATS

This announcement did not go down well with the wider South Africa expatriate community. However, this has been in the pipeline for some time and the bottom line is – you now have to Financially Emigrate under the new stricter regime.