SARS Now Officially Issues Tax Non-Residency Confirmation Letters

If you are a South African tax resident, you are legally required to submit tax returns to SARS each year, declaring your worldwide income, including local and foreign earnings. You may then claim applicable foreign tax credits or exemptions.

However, if you do not formally declare your non-residency to SARS, you will still be treated as a tax resident even if you no longer meet the requirements of the ordinarily resident test, the physical presence test, or if a Double Tax Agreement (DTA) applies.

These factors alone do not change your tax status. The only way to officially cease tax residency is to follow the legal process through SARS.

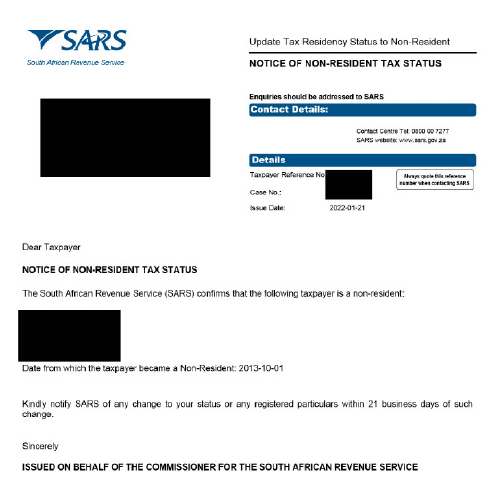

SARS now issues a Non-Resident Tax Status Confirmation Letter, which serves as official proof of your non-residency. While not previously required during emigration, it has become a key step in confirming your updated tax status.

SARS Notice of Non-Resident Tax Status Letter

The SARS Notice of Non-Resident Tax Status Letter serves as official confirmation that you have ceased to be a South African tax resident. This document specifies the effective date on which your tax residency ended.

Taxpayers who previously ceased tax residency and obtained an Emigration Tax Clearance Certificate (ETCC) or a Tax Compliance Status (TCS) PIN for Emigration must also request this SARS confirmation letter. It is now a critical part of the compliance process for former South African residents.

Requirements for the SARS Non-Resident Tax Status Letter

To apply for the SARS Notice of Non-Resident Tax Status Letter, you must:

– Legally meet the criteria for non-residency for South African tax purposes.

– Update your tax status with SARS.

– Complete SARS’s non-residency verification process.

Once verified, SARS will issue the confirmation letter of your non-resident tax status.

AIT PIN Requirement for Offshore Transfers

If you plan to transfer funds abroad, you must apply for the Approved International Transfer (AIT) PIN, introduced by SARS as of 24 April 2023. This AIT PIN is valid for 12 months and replaces both the TCS PIN for Emigration and the Foreign Investment Allowance (FIA) PIN.

Important: If applying for the AIT PIN as a non-resident, the SARS Notice of Non-Resident Tax Status Letter is a mandatory supporting document.

Benefits of Ceasing South African Tax Residency

Becoming a tax non-resident of South Africa offers key financial advantages. Once your non-residency is confirmed by SARS, and your documentation is in order, you can benefit from:

– No tax on worldwide income.

– Simplified tax compliance.

– Greater offshore financial flexibility.

Access to Retirement Funds

After maintaining tax non-residency for three uninterrupted 3 years you may qualify to fully withdraw your South African retirement annuity through Financial Emigration a rare opportunity for early access to your funds.

Ensure your SARS non-residency is properly documented to unlock these benefits. You are only liable for tax on income sourced from within South Africa.

Capital gains tax applies only to fixed property located in South Africa or assets linked to a permanent establishment within the country.

No capital gains tax is charged on any other assets outside South Africa. No worldwide income tax is applied, including on foreign remittances. No donations tax. Limited estate duty.