Confusion over the definitions of foreign income and tax residency.

A residency-based tax system such as in South Africa, requires that its tax residents declare and be taxed on their global earnings. Tax non-residents only declare and get taxed on their income from local sources.

However, confusion abounds among the ranks of expatriate taxpayers, regarding whom is considered to be a tax resident and what qualifies as foreign income. This confusion has brought on non-compliance and mis-declarations from expatriate taxpayers, as such SARS has rightly shown concern and begun questioning resident and non-resident taxpayers on their foreign income.

Who is seen as a tax resident vs a tax non-resident?

In terms of SARS’ practice and the Income Tax Act, No. 58 of 1962, natural persons are seen as ‘tax resident’ as a result of meeting one of the residency tests.

- In making this determination, SARS will first consider whether the taxpayer meets the requirements of the ordinarily resident (i.e., intention-based) test. Under this test, an individual who intends to live in South Africa permanently (now or again at some point in the future) is seen as a tax resident.

- Alternatively, if the taxpayer is already on-record with SARS as a non-resident (such as a foreign national), they may become a resident by being physically present in South Africa for a specific period of time.

The domestic tax residency tests are pivotal in establishing what tax-related obligations may arise for an individual, and are equally crucial for an individual seeking to cut their ties with SARS.

What qualifies as foreign income?

The location where services are rendered will generally determine whether they are considered to be from a South African source or are otherwise foreign-sourced.

The most vital takeaway from this should be (at least with reference to income from services) that the location where one physically performs the services will be the location of the source of the income – it is not where the client or employer is based, it is not the location from which a payment is made, nor is it the location / country that the amount is paid to.

Deeper SARS enquiries around non-compliance.

The misunderstanding of South Africa’s tax residency rules has resulted in a large degree of tax non-compliance by expatriate taxpayers, in relation to the way they have declared their income to SARS (or have not declared their income at all). This is largely the reason for SARS’ current ‘Sherlock Holmes’ approach to the disclosures of foreign income made (or not made) by resident and non-resident taxpayers alike.

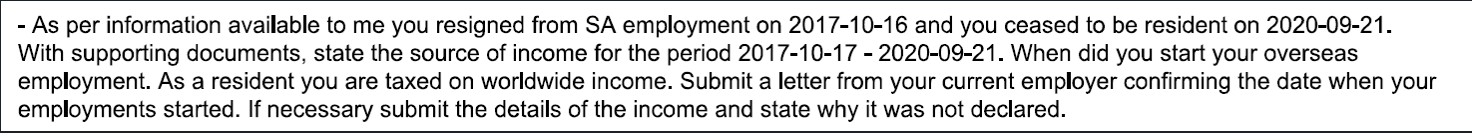

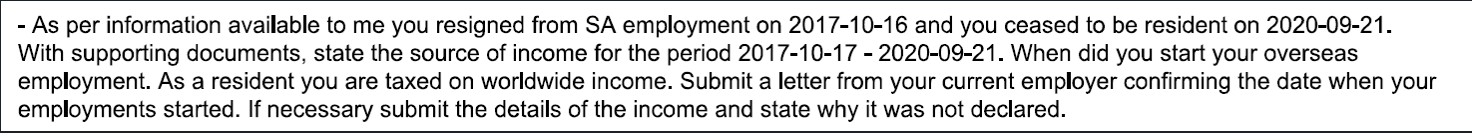

The latest example of SARS’ in-depth inquiries into foreign income disclosures can be seen following a recent application by a tax non-resident for a formal letter from SARS confirming their non-resident status.

Below is a snippet of the query made by the SARS official regarding this particular spousal couple’s income.

- Husband:

- Wife:

This example clearly shows that SARS is not letting any detail go unnoticed. The period referred to in the above example relates to the time period between the applicants’ last known South African employments and the date on which they ceased to be tax residents in South Africa.

Why do these deeper SARS enquiries on foreign income matter?

In the process of confirming a one’s cessation of South African tax residency, SARS will first confirm whether the taxpayer was compliant while being a tax resident in South Africa (and in some cases beyond):

- If the taxpayer earned any income during that period, it needs to have been declared – as they were still tax resident in South Africa – i.e., regardless of whether it was local or foreign income.

- If the taxpayer did not earn any income from any sources worldwide, or they were unemployed during a relevant tax period, it is also prudent to also declare this to SARS even if just for audit trail purposes.

In this particular case, if the taxpayer had erroneously not declared their foreign income to SARS, they may be liable for outstanding tax, and potential non-compliance penalties and interest on the outstanding amount. Their tax residency status may fall into question, and they may not be awarded a non-resident confirmation letter by SARS until all non-compliance is corrected and any funds due to SARS are paid.

Where to from here…

Taxpayers have, many a time, been warned about taking a ‘head in the sand’ approach to their tax affairs. SARS is becoming more inquisitive, assessing each individual’s affairs and thoroughly examining each case on its merits. This approach is taken with both tax residents and non-residents (as a result of the decreasing tax collection pool) as SARS cannot afford to lose any tax collection on foreign income as it contributes so largely to the total collections.

SARS is sharpening its’ investigative skills, especially for expatriates looking to formally cease their tax residency. For an individual who is yet to undergo this process, it should also be seen as a call to widen their own knowledge about what is foreign income and how it is taxed based on their residency.

When going through any tax residency status-altering process or just remaining a compliant taxpayer, it is best to consult with a professional to establish your residency status and associated tax obligations.