THE GOLDEN LETTER: SARS Non-Resident Tax Confirmation

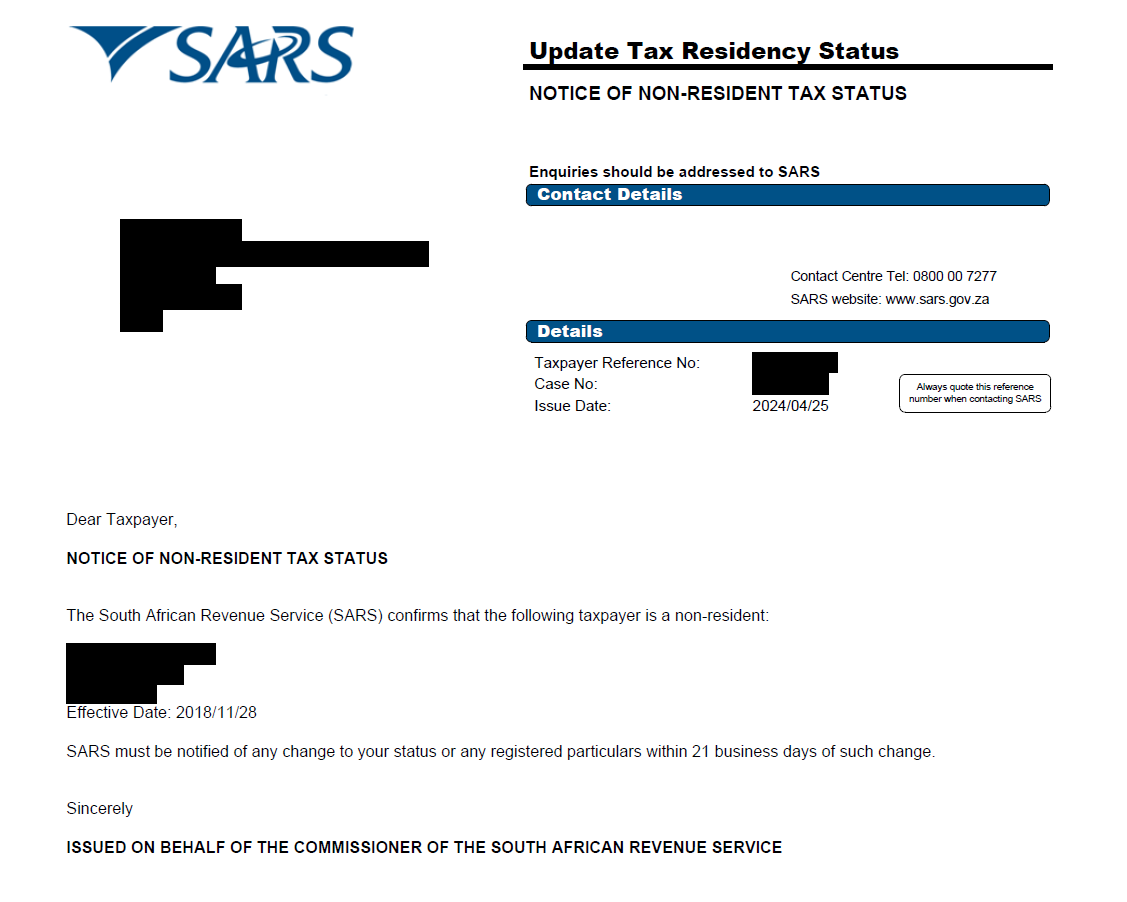

In addition to meeting the three year lock in requirement, you must obtain the SARS Notice of Non Resident Tax Status Letter commonly referred to as the “Golden Letter” to legally and successfully withdraw your South African retirement funds.

TAX NON-RESIDENCY AND POLICY ENCASHMENT | ROADMAP

Where a Double Tax Agreement (DTA) applies, it is essential to determine the correct tax treatment of your policy encashment in advance. Failure to do so could result in double taxation or the need to apply for a SARS tax refund. Our tax specialists offer personalised guidance to help you navigate these international tax complexities.

CONTACT US

ENQUIRE NOW ABOUT OUR FINANCIAL EMIGRATION SOLUTION