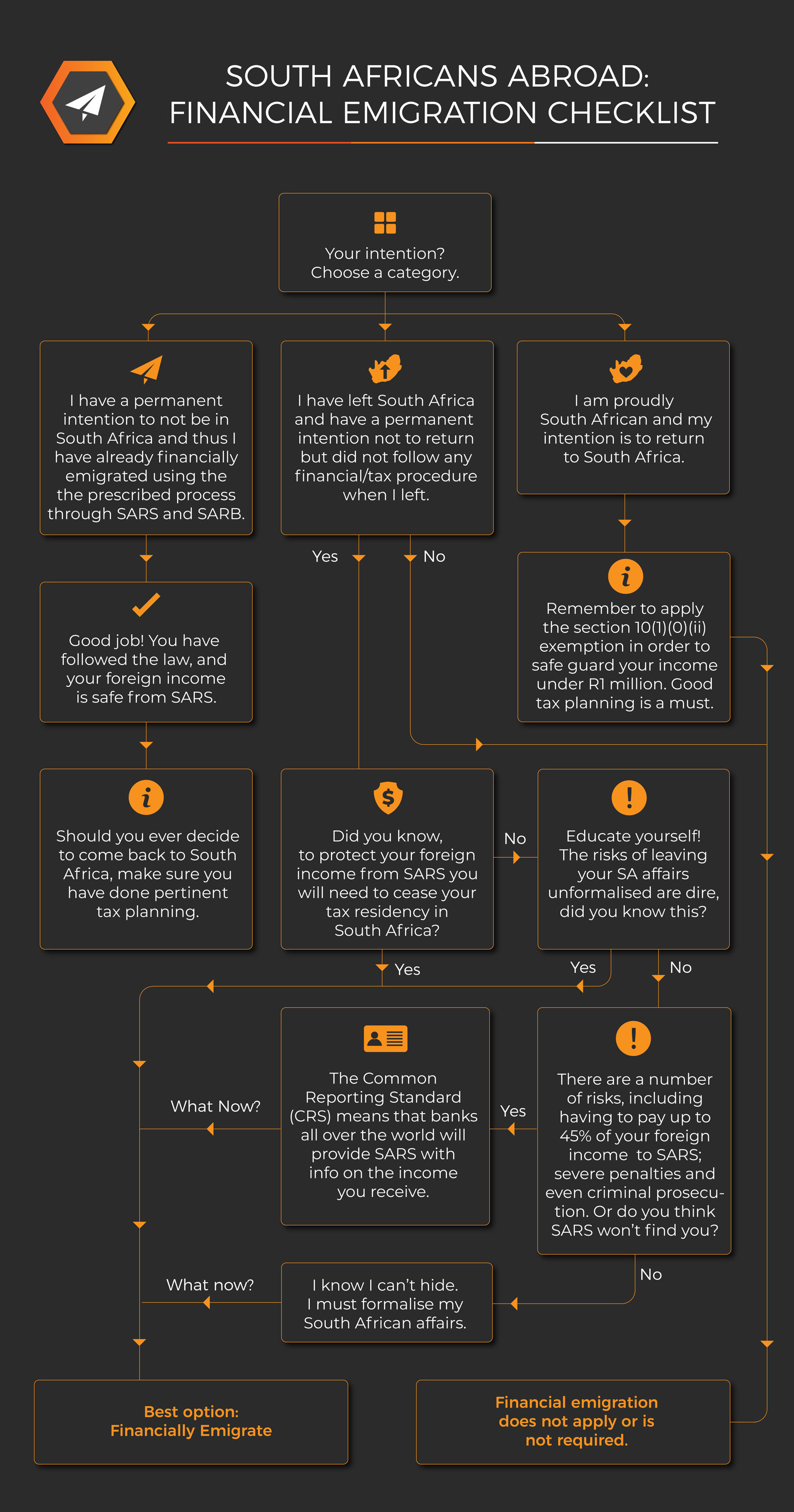

The new expatriate tax law comes into effect 1 March 2020. However, many South Africans abroad believe that the law has not been legally amended and will thus not affect them. This belief is unfortunately incorrect, as the law change has been fully enacted. We have provided a concise breakdown of the tax law above to help you better understand the requirements thereof, and whether or not it is prudent to formalise one’s emigration through SARS and the South African Reserve Bank to protect foreign income earned from South African tax.

Find Us

Johannesburg

17 Eaton Avenue

Bryanston

Gauteng, 2191

South Africa

George

55 York Street

Dormehls Drift

George, 6529

South Africa

Cape Town

1002 Harbour Bridge,

Dockrail Road,

Cape Town, 8001

South Africa

Contact Details

Telephone:

South Africa: 011 467 0810

International: +27 11 782 5289

Email:

contact@financialemigration.co.za

In the News